Prelude - yes, I decided to dust off the old blog, actually the ORIGINAL blog, for this article because I've turned some of the others off. I've gotten too busy to maintain all the separate sites so I decided I'll just post content here if I want to share something off of social media. (It can't get banned here lol).

Race to the Bottom

I'm not an economist. I don't have a masters in sociology or anything else related to the human condition, but I do live here amongst the rest of us and I listen to the news pretty much daily and as I hear and read these articles on multiple subjects I can't help but feel like they're connected. I find myself wondering if the economic analysts and the jobs analysts and the market analysts ever just get together and have a drink and share ideas. Because some of this is just too common sense not to be related.

Worker Strikes

We're undergoing quite a few strikes across the country right now. Writers guild, actors guild, healthcare workers, union auto workers, and probably a dozen more I don't know about. They all have one thing in common; they're about money. Everyone wants more money. I'm neither agreeing nor disagreeing with their stance. I'm merely pointing it out. Most of them feel undervalued in one way or another and that value is normally equated somehow to a financial figure. I don't need to dive much deeper than that for most of these organizations to make my point.

Jobs Market

The news today in one podcast mentioned how we added 336,000 jobs in September, which blew away the expected number of 170,000. So we DOUBLED the number of jobs they expected to be filled in September. Keep that in mind and consider the next paragraph.

Unemployment is high

Unemployment is at it's highest since Feb 2022 - so almost two years. But the same report says that unemployment is low and stable, resting around 3.5% right now. Ok... where are all these workers?

Entire job fields are suffering

So if unemployment is low/high/stable (still can't make sense of that one) and we're adding 336,000 jobs a month - why is almost every major critical field suffering from not being able to hire?

Doctors - overworked and under staffed.

Nurses - overworked and understaffed.

Veterinarians - none available despite tremendous salary increases in recent years.

Veterinary Technicians - same argument. Not enough to go around.

Veterinary Technicians - same argument. Not enough to go around.

I listened to a podcast today where a college is coming under fire for not being able to accept enough students. More students want to go, but there's not enough professionals to instruct them, so classes are fewer and far between because they can't instruct them - which means less of them coming into the job market in 4 years - which means even less instructors in 5 years - which means even less coming into the... you get the idea right?

People aren't taking jobs:

It doesn't matter if its fast food, fine dining, retail shelf stocking, manufacturing, or neurosurgery. People are simply NOT taking the jobs they normally would. It's not 100% a lazy entitlement attitude, though I firmly believe that exists in higher percentages than any other period in our history. It's math. The reason they're not taking the job is math.

Employers have increased wages maybe 10% to attract employees. That's great...except that anyone that's ever gone grocery shopping knows that inflation is leaving that figure in the dust.

Do I really need to be the one to explain this?

Let's do this barney-style.

Let's base it on coca-cola - a simple drink people purchase.

Three years ago it was $5 for a 12-pack.

Last year it was about $6.50 for a 12-pack.

Today it's $8.00 for a 12-pack.

These are walmart prices - not bougie higher-end markets.

So in 2021 coke was one price. Then it jumped 33 percent in a year. Then it jumped another 19 percent this year (so far).

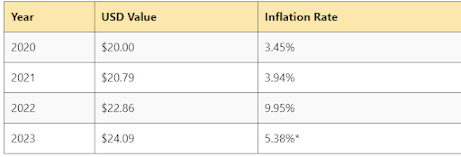

But let's use actual normal inflation numbers for food:

If you wanted to match that with a given hourly wage - and I'm a normal employee somewhere that used to make $11 an hour but now you're offering me $15 an hour, how does that breakdown for my grocery bill? And let's further assume I used to have a grocery bill of $100 a week in 2020. (That's about what ours was a couple years ago).

My weekly grocery cost in 2020: $100 = $5,200 a year.

My weekly grocery cost in 2021: $103.94 = $5404.88 a year.

My weekly grocery cost in 2022: $114.28 = $5,942.56 a year.

My weekly grocery cost in 2023: $120.43 = $6,262.36 a year.

Now, let's factor in just rent increases. That's one that a huge percentage of people are dealing with.

NC inflation for rental prices jumped 20% in 2022 over 2021. In 2023, the total jumps to 32% higher than 2021.

Median rent is currently $1,183 per month in NC in October 2023, so let's roll that back to get good numbers. I'm going to use $1,200 to have an even number to work with.

2021 median rent: $806.40/month = $9653.28 a year.

2022 median rent: $960.00/month = $11,200.00 a year.

2023 median rent: $1200/month = $14,400 a year.

That's just two simple figures - groceries and rent. Literally only putting food in your face and a roof over your head. That's not counting heating it, cooling it, cooking in it, water, etc. Just two things every single one of us have to deal with in some form or fashion.

So, these two costs alone change as follows for rent and groceries.

- 2021 - $15,058.13 per year.

- 2022 - $17,142.56 per year.

- 2023 - $20,662.36 per year.

Let's say I made $11/hour in 2020 and you've now raised me to $15 an hour in 2023. I work 40 hours a week at a regular job, no fancy vacations, but assume I get about 1 week off a year and we can't factor in overtime because that's unknowable.

In 2021: my total salary would be $22,400 per year gross, so about $17,054 take home pay.

I literally have a total of $166.36 a week to survive on for clothes, gas, medical costs, etc.

In 2023: you're bumping up my pay, so now at $15/hour it would be $30,600 per year gross, so about $23,256 a year in take home pay.

I literally have a total of $216.14 a week to survive on for clothes, gas, medical costs, etc.

Between 2021 and 2023, the cost to survive in America for a normal person paying a normal rent and a fairly small grocery bill for a family, has jumped 27%. That's literally only factoring TWO parts of life. Let's not even TALK about car payments, loan interest, etc.

So a pay boost from $11 to $15 for every employee out there, isn't actually a raise. It's literally EXACTLY level with the cost of living (using only 2 points of reference).

In laymen's terms, a $4/hour raise is literally, at the VERY BEST, allowing me to bring home close to what I brought home three years ago. It's absolutely ZERO points above the cost of living, and if you factored in everything else, it's probably less.

That's just math -feel free to do it yourself. I spelled it all out so you can check my numbers.

How do businesses solve it?

Solving it for businesses is simple. You want to know why Gatorade is now $3 a bottle instead of $1.79? One reason is they have to give employees more money. They raised prices and passed the cost on to you.

Coke has jumped 50% in three years.

Batteries, smokes, jeans, rubbermaid, dishes, you name it and the cost has gone up.

Let's say businesses on average jump prices about...oh I dunno... 27% to match the cost of that raise they just gave employees.

Guess what?

Next year, the cost of living for your employees, just jumped a matching 27%, which means in order to bring home the same thing they did in 2023, you're going to have to give them a raise from $15/hour to $19.05/hour just for them to bring home the same money and survive.

It's a literal war between commerce and workers.

Companies have to raise prices to meet demands of, among other things, recruiting employees. Employees have to demand more because all the things they buy are going up because of the rise in demands to meet their salary requirements. No one is getting rich. Everyone is skating by at best. Prices still keep going up because ONE side has to give in first or the system will never stop growing out of control.

How to workers solve it?

They stop taking the jobs. They're finding work... somewhere they're finding work. They're bunking up with four people in a two bedroom apartment somewhere to make ends meet, but they're not dying in the streets in droves or wandering into FEMA homeless encampments, so they're doing it somehow. How long they can sustain it remains to be seen, but they're managing to do it.

But now they can't take that job at $15 an hour because it takes $19 an hour just to keep the lights on. Forget about saving for the future, or putting a down payment on a new car. That's not in their future at the moment.

Colleges are turning out less doctors, veterinarians, police, fire fighters, engineers, and more. The demand for those jobs is steadily going up. You think you've got it tough hiring employees for $19 an hour and figuring out how to pay for it? My wife owned a veterinary practice.... built it from the ground up herself over 17 years. We tried for THREE years to hire veterinarians. You know why? This will blow your mind...

Veteran doctors, herself included, were making around $85K-$90K per year gross. New grads - and I mean ALL of them - are demanding $125K to even show up to an interview. Let that sink in for a moment. Imagine having to hire someone at $125K when the doctor you work beside that's been a doctor for 30 years is making $85K.

Imagine having to hire 4 more police officers at $55K a year (plus their related law-enforcement retirement costs) when the ones you work with that have been there for 15 years are making $44K.

You can't do it. To attract police officers currently requires about a 50% increase in what's being offered. Veterinarians is about the same 40-50% pay increase to get them in the door - and these are NEW people, fresh off the boat, no experience at all.

Doctors? Ha! I've got a doctor friend, relatively young... she didn't even consider taking a job (fresh out of college) unless it paid over $300K a year on DAY ONE of their employment. (And they got it by the way... people lining up to pay it... because they desperately need doctors.)

We're literally in a race to the bottom

I look at this from the outside and wonder if anyone else sees this? The only solution I see is for the government to get out of the way, let the inevitable recession happen, let free-market economy fall through the floor and eventually re-stabilize at something probably similar to 2017-2017 levels, and start again.

Colleges will fail for a bit as they realize that on one is willing to pay $46,000 a year for a basic education. Professor's salaries will drop accordingly. Police forces will continue to decline until costs drop to where they can afford to take that job for a price the department can pay. That back and forth will go on across all industries as each market settles back into its equilibrium and then settles against each other's new pricing realities.

Am I wrong?

Discuss...